Hedging spiegelt das tatsachliche finanzielle ergebnis das durch die kursvolatilitat nicht beeinflusst wird. Hedging is a strategy to protect ones position from an adverse move in a currency pair.

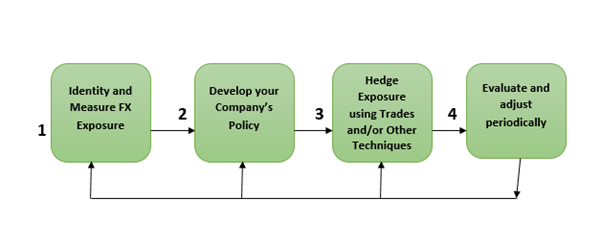

Why Hedge Four Common Approaches To Fx Risk Management Encorefx

Why Hedge Four Common Approaches To Fx Risk Management Encorefx

Forex hedging ist eine massnahme mit der sie sich gegen volatilitat absichern konnen.

Hedg! ing forex exposure. In this case it wouldnt be exact but you would be hedging your usd exposure. Es zeigt auch die preise der produktion lohne und sonstige kosten im voraus an. Hedging currency risk is a useful tool for any savvy investor that does business internationally and wants to mitigate the risk associated with the forex currency exchange rate fluctuations.

Forex traders can be referring to one of two related strategies when they engage in hedging. Erfahren sie hier wie sie hedging strategien einsetzen konnen. What is forex hedging and how do i use it.

9 minutes this article will provide you with everything you need to know about hedging as well as what is hedging in forex an example of a forex hedging strategy an explanation of the hold forex strategy and more. Exposure netting is a method of hedging currency risk by offsetting exposure in one currency with exposure in the same or another currency. For example y! ou could buy a long position in eurusd and a short position in! usdchf.

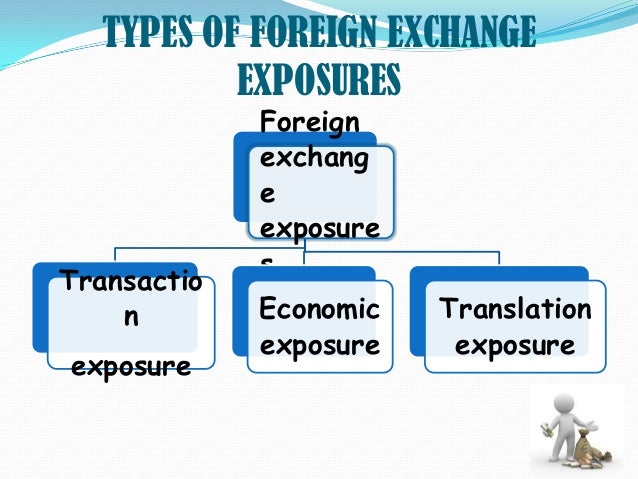

Hedging ermoglicht dem unternehmen einem moglichen risiko der wechselkursschwankungen zu begegnen und weitere arbeit zu planen. Foreign exchange exposure definition. This article addresses foreign exchange fx risk examines a large swiss multinational company and the impact on its financial statements second half.

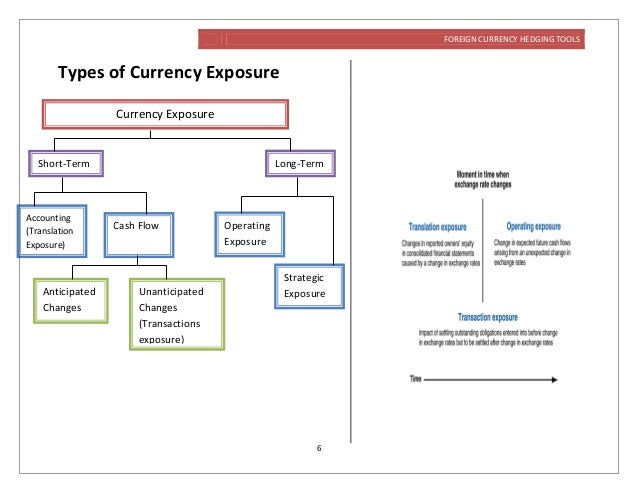

A forex trader can make a hedge against a particular currency by using two different currency pairs. Which strategy is right for your business. Foreign exchange exposure refers to the risk associated with the foreign exchange rates that change frequently and can have an adverse effect on the financial transactions denominated in some foreign currency rather than the domestic currency of the company.

Transaction Exposure Financial Operational Techniques To Manage It

Transaction Exposure Financial Operational Techniques To Manage It

How Companies Use Derivatives To Hedge Risk

Hedging Foreign Exchange Risk Exposure By Importer Companies

How Multinational Treasurers Hedge Their Foreign Exchange Exposure

Was Ist Forex Hedging Und Welche Hedging Strategien Gibt Es

Was Ist Forex Hedging Und Welche Hedging Strategien Gibt Es

The Ultimate Fx Exposure Management Solution Hedging Combination

The Ultimate Fx Exposure Management Solution Hedging Combination

Getting A Grip On Foreign Exchange Blackrock Investment Institute

Getting A Grip On Foreign Exchange Blackrock Investment Institute

Foreign Exchange Risk Exposure Management Foreign Exchange Risk

Foreign Exchange Risk Exposure Management Foreign Exchange Risk

Companies Leaving Forex Exposure Without Hedging Rbi S Market

Companies Leaving Forex Exposure Without Hedging Rbi S Market

Foreign Exchange Hedging Tools

Foreign Exchange Hedging Tools

Foreign Exchange On Balance Sheet Hedge

Foreign Exchange On Balance Sheet Hedge

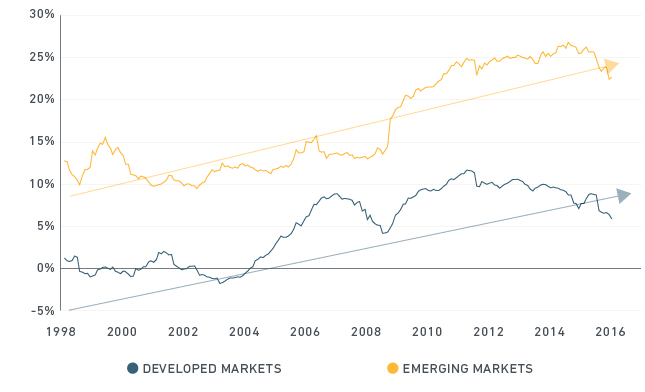

Should You Hedge Your Foreign Currency Exposure Msci

Should You Hedge Your Foreign Currency Exposure Msci

Foreign Exchange Risk And Hedging

Foreign Exchange Risk And Hedging